Aggregate demand (AD) is the total demand for final goods and services in a given economy at a given time and price level.

There are four components of Aggregate Demand (AD); Consumption (C), Investment (I), Government Spending (G) and Net Exports (X-M). Aggregate Demand shows the relationship between Real GNP and the Price Level.

Factors that Affect Aggregate Demand

1. Net Export Effect

When domestic prices increase, then demand for imports increases (since domestic goods become relatively expensive) and demand for export decreases.

2. Real Balances

When inflation increases, real spending decreases as the value of money decreases. This change in inflation shifts Aggregate Demand to the left/decreases.

3. Interest Rate Effect

Real Interest is the nominal interest rate adjusted to the inflation rate. When inflation increases, nominal interest rates increase to maintain real interest rates. Lower real interest rates will lower the costs of major products such as cars, large appliances, and houses; they will increase business capital project spending because long-term costs of investment projects are reduced.

4. Inflation Expectations

If consumers expect inflation to go up in the future, they will tend to buy now causing aggregate demand to increase or shift to the right.

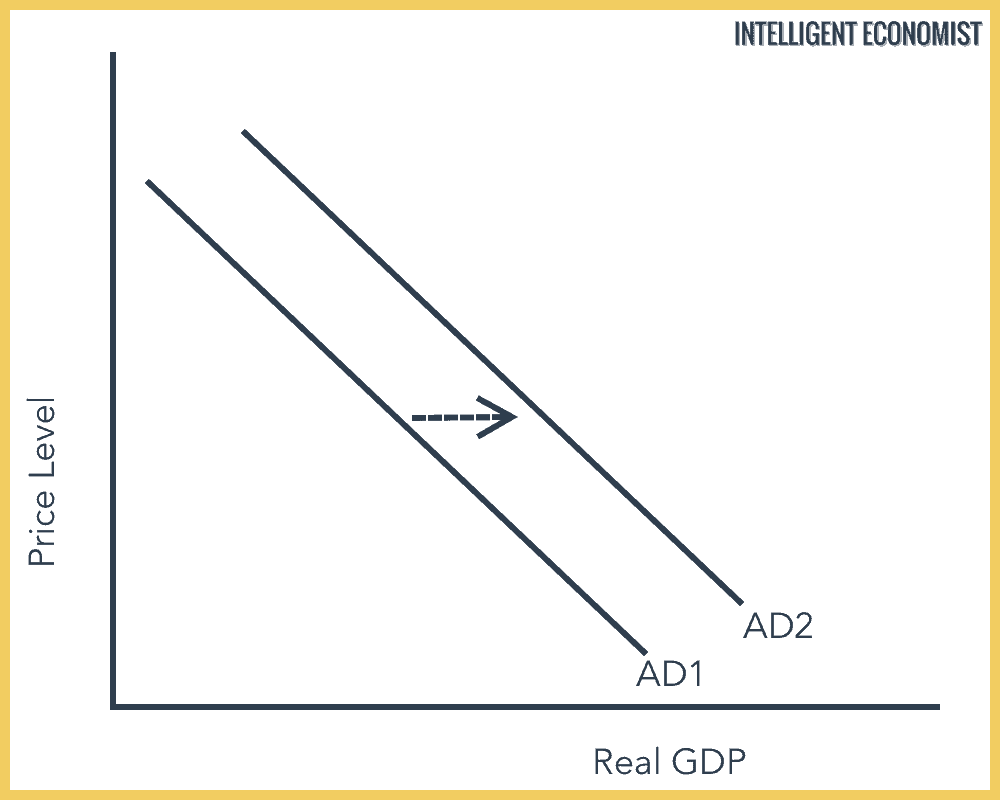

Four Components of Aggregate Demand

Any increase in any of the four components of aggregate demand leads to an increase or shift in the aggregate demand curve as seen in the diagram above.

Aggregate Demand = C + I + G + (X-M)

Consumption

This is made by households, and sometimes consumption accounts for the larger portion of aggregate demand. An increase in consumption shifts the AD curve to the right.

Factors that Affect Consumption

1. Consumer Confidence

If consumers are confident about their future income, job stability, and the economy is growing and stable, consumer spending is likely to increase. However, any job insecurity and uncertainty over income is likely to delay spending. An increase in consumer confidence shifts AD to the right.

2. Interest Rates

Lower interest rates tend to increase consumption because consumers purchase larger goods on credit. If interest rates are low, then it’s cheaper to borrow. Consumers mostly borrow to buy houses, which is one of the biggest purchases and lower interest rates mean lower mortgage payments so that households can spend more on other goods. Some Economists argue that lower interest rates also make saving less attractive, but there is no real evidence. So, lower interest rates increase Aggregate Demand.

3. Consumer Debt

If a consumer has a lot of debt, he is unlikely to buy more since he would have to pay his debt off first. Low consumer debt increases consumption and aggregate demand.

4. Wealth

Wealth is assets held by a household, such as property or stocks. An increase in property value is likely to increase consumption.

Investment

Investment, second of the four components of aggregate demand, is spending by firms on capital, not households. However, investment is also the most volatile component of AD. An increase in investment shifts AD to the right in the short run and helps improve the quality and quantity of factors of production in the long run.

Factors that Affect Investment

1. Interest Rates

Firms borrow from banks to make large capital intensive purchases, and if the interest rate decreases, it becomes cheaper for firms to invest and provides an incentive for firms to take on risk.

2. Business Confidence

If firms are confident about the economy and its future growth, they are more likely to invest in capital, new projects, and buildings/machinery.

3. Investment Policy

If governments provide incentives such as tax breaks, subsidies, loans at lower interest rates then investment can increase. However, corruption and bureaucracy deter investment.

4. National Income

As firms increase output, they would need to invest in new machines. This relationship is known as The Accelerator. The assumption behind the accelerator is that firms will want to main a fixed capital to output ratio, meaning that if a factory uses one machine to produce 1000 goods, and the firms needs to produce 3000 goods more, then the firm will buy 3 more machines.

Government Spending

Government spending forms a large total of aggregate demand, and an increase in government spending shifts aggregate demand to the right. This spending is categorized into transfer payments and capital spending. Transfer payments include pensions and unemployment benefits and capital spending is on things like roads, schools, and hospitals. Governments spend to increase the consumption of health services, education, and to redistribute income. They may also spend to increase aggregate demand.

Net Exports

Imports are foreign goods bought by consumers domestically, and exports are domestic goods bought abroad. Net exports are the difference between exports and imports, and this component can be net imports too if imports are greater than exports. An increase in net exports shifts aggregate demand to the right. The exchange rate and trade policy affects net exports.