Allocative efficiency is the level of output where the price of a good or service is equal to the marginal cost (MC) of production. Allocative efficiency is achieved when goods and/or services are distributed optimally in response to consumer demands (that is, wants and needs), and when the marginal cost and marginal utility of goods and services are equal.

Allocative efficiency is also referred to as Allocational Efficiency.

What is Allocative Efficiency?

The term refers to the degree of equality between the marginal benefits and marginal costs. The marginal cost is the cost of producing one additional item and is used to pinpoint the optimal economy of scale. The marginal benefit is the greater enjoyment created by producing one additional piece.

Allocative efficiency will occur when both consumers and producers have free access to information (so no asymmetric information), allowing them both to make the most efficient possible decisions in purchasing and production. According to this principle, it is also necessary that consumers have free choice over the goods/services that maximize their individual satisfaction. Allocative efficiency happens when resources in the market are correctly allocated in response to consumers’ desires as well as their needs.

Why does Allocative Efficiency matter?

Operating under allocative efficiency ensures the correct resource allotment in terms of consumer needs and desires. Virtually all resources (i.e., factors of production) are limited; therefore, it is essential to make the right decisions regarding where to distribute resources in order to maximize value.

The aim is to achieve the ideal opportunity cost. The opportunity cost of a particular thing is the value that must be sacrificed in order to put resources of time, money, etc. toward that thing.

Economies of scale ensure that opportunity costs decrease as production levels increase, up to a point. Then, past certain levels of production, opportunity cost may begin to increase once again. Likewise, with higher supply, demand decreases.

The market equilibrium is the point at which value for society as a whole has been maximized. It is at this point that allocative efficiency has been achieved. For these reasons, aiming to achieve allocative efficiency is valuable to both consumers and producers.

In an allocatively efficient market, actors throughout both the private and public spheres allocate their resources toward the investments that will collectively benefit everyone in their society the most. Simultaneously, their investments also maximize profits and spur economic growth.

The Relationship Between Allocative Efficiency and Efficient Markets

Allocative efficiency occurs in highly efficient markets. In such markets, goods/services are as well distributed as they could be for all buyers/consumers in that economy. In other words, allocative efficiency means that resources—meaning capital, goods, and services—are allocated in an optimal way. That is, no variation in the allocation of these resources could lead to better outcomes for the economy as a whole and its participants. Markets must be both informationally and transactionally efficient for true allocative efficiency to persist.

Informational Efficiency

All economic actors in an allocatively efficient market have an abundance of high-quality information available to inform all of their economic decisions. This data allows producers and firms to determine where their investments will create the highest profits, benefit the public the most, and fuel the highest amount of economic growth.

Transactional Efficiency

Transactionally efficient markets are those in which the costs of transactions are not overblown, but are instead justified based on the resources required for each kind of transaction. Anyone who needs to do so can engage in all transactions, which allows access to the market for all. When the market is transactionally efficient, capital will naturally move toward the locations at which they will provide the most general benefit. That is, capital will end up allocated in such a way that investors experience the ideal balance between risks and rewards.

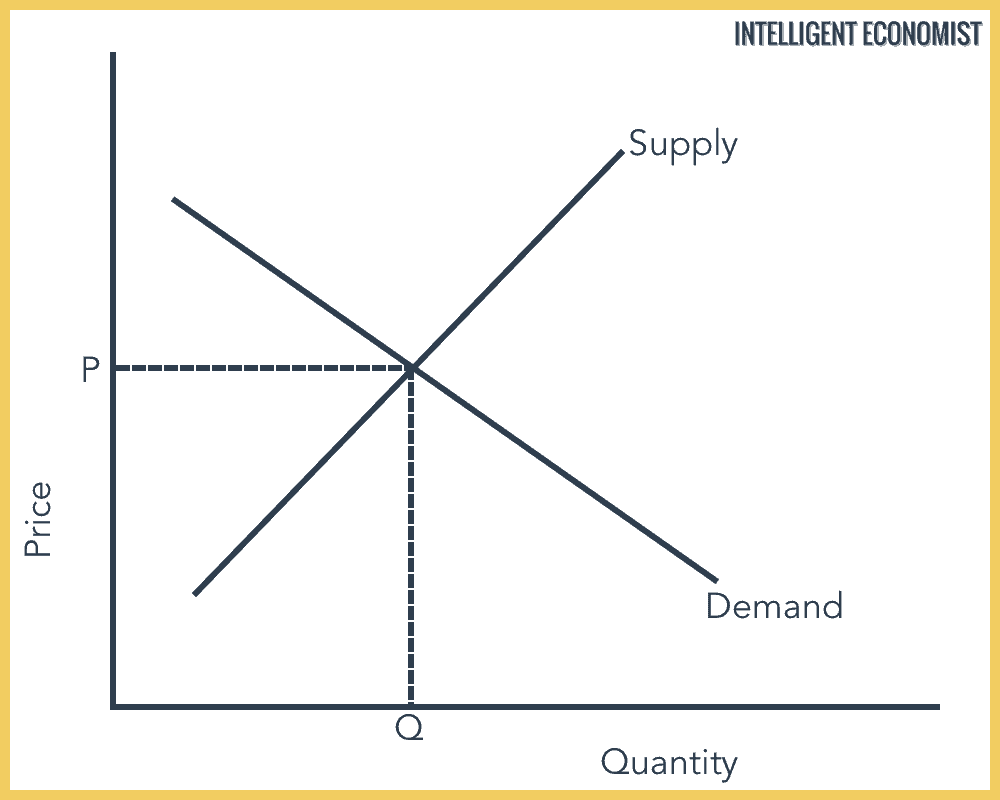

Allocative Efficiency Graph

As the graph above shows, allocative efficiency is found at the point where the supply and demand curves intersect. At this point, the demand for some form of supply is at the same level as the price that is given for that form of supply. The result is that all of that product is sold with nothing going to waste.

Allocative Efficiency Example

Let’s say someone decides to buy a new suit and goes to a clothing shop. The shop is going to have the cuts and colors of suits that are most in-demand. They’re much more likely to have the standard navy blue suits available for sale than something with much lower demand like a bright green suit, even if there are a few consumers who’d love a more unusual color.

This reality is in line with allocative efficiency: the suits that are available are limited because clothing retailers’ resources are not infinite. Retailers need to put their energy into the styles that are in the highest demand. Putting resources toward the items in highest demand helps them achieve higher profits.

In this case, the marginal benefit of the person in this example who is going to the clothing shop is near equal to the clothing shop’s marginal cost: the amount they will pay for more suits. Even though some consumers might want a bright green suit, the majority will prefer navy blue, so clothing manufacturers will put their resources (advertising and production dollars) toward navy blue suits.

Allocative vs. Productive Efficiency

Productive efficiency centers around producing goods at the lowest possible cost. This is based on the method of production, in contrast to the allocative efficiency, which focuses on the amount that is produced.

Productive efficiency and allocative efficiency are two ideas that are very different, although they are certainly connected.

If you produce unwanted amounts of goods in a highly efficient manner, you have achieved high productive efficiency, but low allocative efficiency. Both allocative and productive efficiency must be reached to maximize satisfaction for as many people as possible, and thus benefit society as a whole.

Why Monopolies Promote Allocative Inefficiency

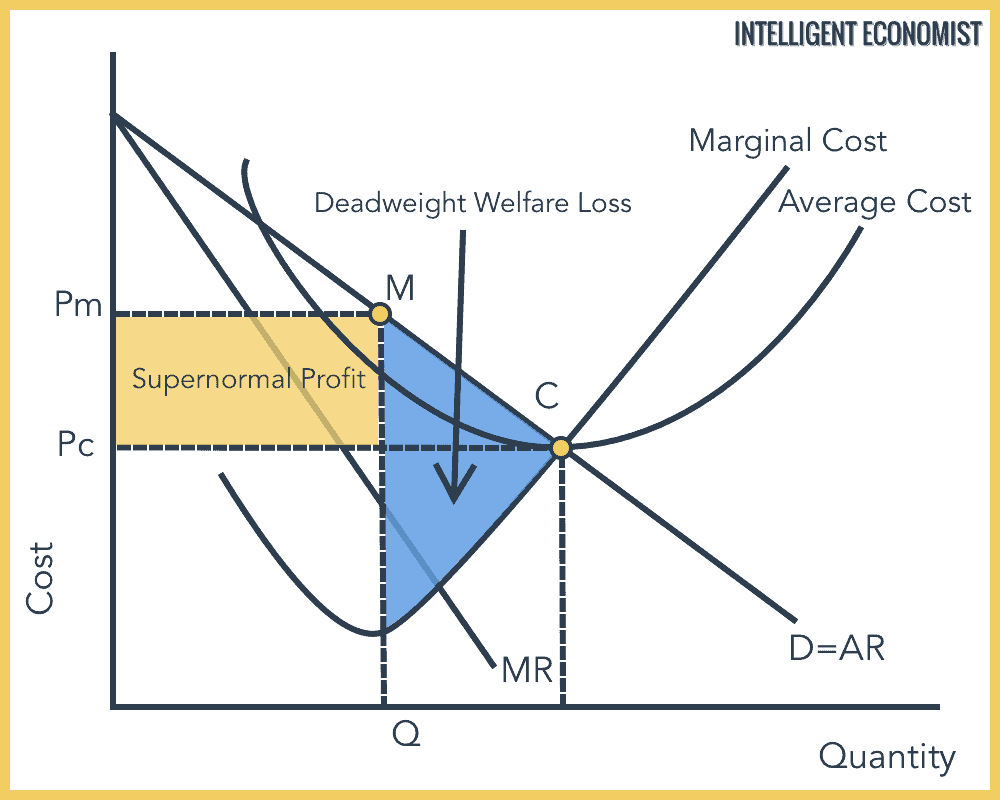

Monopolies are, by their very nature, the opposite of allocatively efficient. They tend to inflate prices higher than the marginal cost of production, creating allocative inefficiency. The concentrated, excessive market power held by monopolies leads to increased prices along with lower consumer surplus. The graph below demonstrates this tendency:

To sum up the contents of this graph, the firm holding the monopoly has designated the price labeled “Pm.” This point is allocatively inefficient since this output of “Qm” has the price as greater than “MC.” The point at which MC crosses the demand curve (price is equal to MC) is the point of allocative efficiency. The space marked above as that of “deadweight welfare loss” is representative of this economy’s allocative inefficiency.