A bond is a type of financial instrument. Bonds are debt that firms and governments can issue to raise money and they earn interest.

Characteristics of Bonds

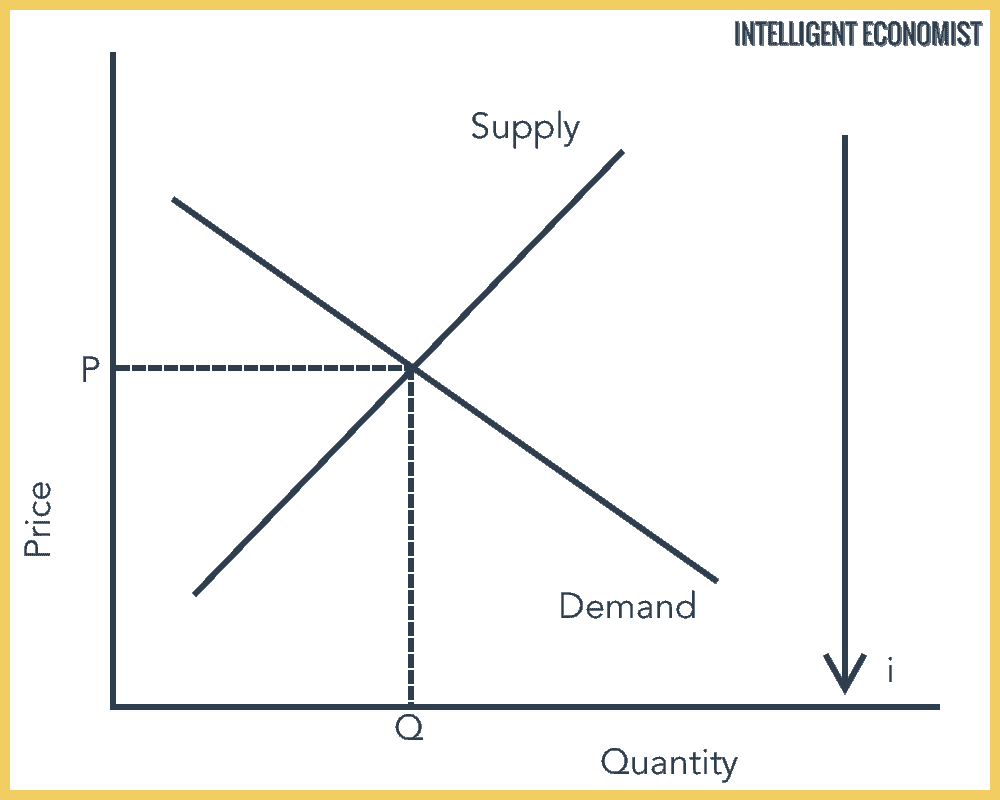

1. Inverse Relationship

There is an inverse relationship between the price of a bond and the market interest rate. Bonds have a resale (or secondary) market. A bond’s secondary market value is it’s Present Discount Value = Face Value/(1+i)n

2. Interest Rate Risk

Bonds have interest rate risk. The longer the term of the bond, the higher the interest rate risk.

3. Yield to Maturity

Yield to Maturity is the effective interest rate as determined by the bond’s future payment schedule and its price. If it is based on the market interest rate, the bond sells for less than PDV, (i.e. bond is a bargain), then yield to maturity > i

Types of Bonds

1. Coupon Bonds

Coupon Bonds sell at or near face value (at par).

Example of a coupon bond:

Ex: $1000 coupon bond sells at approximately $1000

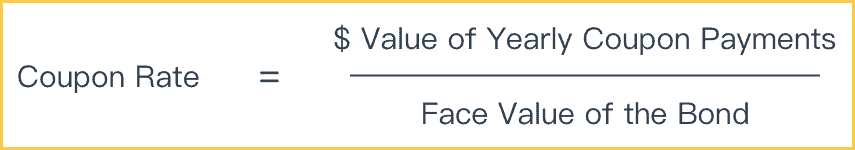

Coupon rate = Dollar value of yearly coupon payments/face value of the bond

Ex: $1000 face value, coupon bond that pays 5% coupon rate will make annual coupon payments of $50.

2. Discount Bonds (zero-coupon bonds)

They sell at less than face value; they pay no interest or coupons until the bond matures. The U.S. savings bond is a discount bond.

Price, Pd & Interest, interestd are jointly determined.

Interest = [(Face value of a bond/ Present Discount Value)^(1/N) – 1] * 100

Example of a Discount Bond

Ex: 1 year $1000 discount bond

id = [(Face value of a bond/ Pd)1/N – 1] * 100

Sells for $900

id = [(1000/9000)1 – 1] * 100 = 11.1%

Ex: Same as above except 2 year bond

id = [(1000/900)0.5 – 1] * 100 = 5.4%

Pd = face value/ (1 + id)n = PDV

Present Discount Value (PDV) = C (coupon payment) / (1 + i) + C / (1 + i)2 + C / (1 + i)3 + …. + C (coupon payment) / (1 + i)N + Face Value/ (1 + i)n

Ex: PDV of 2 year coupon bond, face value = $1000

Coupon payment = $50

Coupon rate – 5%

PDV = 50/(1+0.05) + 50/(1+0.05)2 + 1000/(1 + 0.05)2 = $1000

Face Value = PDV as long as coupon rate = market interest rate

3. A Consol

A counsol is a type of coupon that pays forever but never pays the principal.

PDV of fixed payment in perpetuity = Fixed Income / i

Example of a Consol

Ex: C = $50 forever

i =5%

PDV = 50/0.05 = $1000

Inverse Relationship

Ex: 1 year, $1000 face value discount bond

id Pd

0% 1000/(1 + 0) = $1000

1% 1000/(1 + 0.01) = $990.10

5% 1000/(1 + 0.05) = $952.38

10% 1000/ (1 + 0.1) = $909.09

100% 1000/ (1 + 1) = $500

The Bond Price Interest Relationship

If interest goes up:

Discount Bonds (New): Pd goes down

Discount Bonds (Old): Pd falls (resale market)

Coupon Bonds (New): price unchanged (coupon rate changes) but if coupon rate is lower, then price falls

Coupon Bonds (Old): Pd falls (resale market)

Demand And Supply in Bond Markets

With the third axis, this is known as the Loanable Funds Framework

ib = {(Face Value/Pd)1/N – 1} X 100

ib and Pb are inversely related