Comparative advantage is a situation in which a country may produce goods at a lower opportunity cost than another country, but not necessarily have an absolute advantage in producing that good. More simply, this means that a country can produce a good at a lower cost than another country.

What is Comparative Advantage?

Economist Adam Smith advocated the theory of absolute advantage, where he argued that a country should choose to produce a good if it can produce more of the good with the same or fewer resources than another country. This theory is different from comparative advantage.

David Ricardo, another economist, suggested that a country only needs to have a comparative advantage when deciding if it should produce a good. He published this theory of comparative advantage in 1817, in his highly influential book titled “On the Principles of Political Economy and Taxation.” (Interestingly, some historians of economics suggest that Ricardo’s editor, James Mill, included the theory of comparative advantage in his book. They note that it is not in line with the contents of the rest of the book, so it does not seem to be the product of Ricardo’s mind.)

Ricardo used an example involving wine and cloth production by England and Portugal. As he described it, Portugal could produce wine and cloth using less labor than England, but England was better overall at producing cloth than Portugal. Thus, England should produce cloth and export it to Portugal; Portugal should produce wine and export it to England. This is the most efficient production and exchange for both countries.

Why Does Comparative Advantage Matter?

The concept of comparative advantage isn’t just important—it’s one of the most significant ideas in the field of economics as a whole. That’s because it underlies an absolutely crucial point: that parties like states may always derive economic benefit through trade.

This realization on the part of foundational economists like Adam Smith David Ricardo has been fundamental to the nature of our economic system in the modern era. For this reason, any understanding of international trade depends on a strong understanding of comparative advantage.

The Crucial Role of Opportunity Cost in Comparative Advantage

In order to understand comparative advantage, you should understand how opportunity cost works. The opportunity cost is the benefit lost in making one economic choice over another economic choice that was available to you.

When you’re talking about comparative advantage, the opportunity cost is lower for one actor than another, meaning that the potential benefit lost by making a choice is lower for one actor than another. Whichever actor has a lower opportunity cost has a lower loss of such benefit and thus has comparative advantage. In a trade-off, the better choice has a lower opportunity cost and also has a comparative advantage.

Absolute Advantage vs. Comparative Advantage

The theory of comparative advantage is similar and related to that of absolute advantage, but the two economic concepts are definitely distinct. Absolute advantage describes the overall ability of a country to produce a good better and with fewer resources than another country. When a country has this ability, it has an absolute advantage over another country.

Meanwhile, comparative advantage incorporates the idea of opportunity cost into the analytical choice to produce certain goods or services. Comparative advantage involves the production of goods/services at a lower opportunity cost, not specifically at a higher quality or level of production.

Comparative Advantage vs. Competitive Advantage

Competitive advantage is the capacity of a country (or on smaller scales, of a company) to offer higher levels of value to consumers than other countries, companies, etc. It is also similar to comparative advantage, but not identical in nature.

There are three primary ways that an actor can gain a competitive advantage over other economic actors:

- By offering higher quality goods/services than the competitors,

- By offering its goods and services at a lower cost than competitors,

- Or by narrowing their customer base to a particular segment of the larger pool of consumers by offering a product with niche appeal

Factors Affecting Comparative Advantage

1. Factors of Production

A major factor that affects comparative advantage is the country’s quality and quantity of the factors of production. For example, the natural availability of mineral resources like iron, gold, and copper is not something a country can change.

2. Exchange Rate

Movements in exchange rates affect the prices of imported and exported goods. For example, if your home currency depreciates which means foreign currency can buy more of your home currency, then your exports will increase as your goods are cheaper relative to others.

3. Inflation

An increase in the rate of inflation would make exported goods more expensive and imported goods cheaper.

4. Trade Barriers

Subsidies and taxes are examples of trade barriers that can be implemented by the government to create an artificial comparative advantage. A subsidy would make exports more competitive and a tariff would discourage imports.

Assumptions in Comparative Advantage

1. Constant Returns to Scale

The theory of Comparative Advantage assumes that the costs remain constant for producing any number of goods. This means that if you require 2 hours to make one shirt, then you will spend 10 hours to make five shirts, 20 hours to make ten shirts, etc. In reality, costs will go down because of economies of scale.

2. Mobility

There is perfect mobility of the factors of production. This means that we assume that we can move any factor of production to any part of the country at any time. In reality, we cannot move factors of production easily.

3. Costs

There are no transportation costs, i.e. it does not cost anything to move goods from one place to another. This assumption is also not rooted in reality.

4. Free Trade

Free trade exists between the two countries. This means there are no barriers to trade.

Comparative Advantage Example

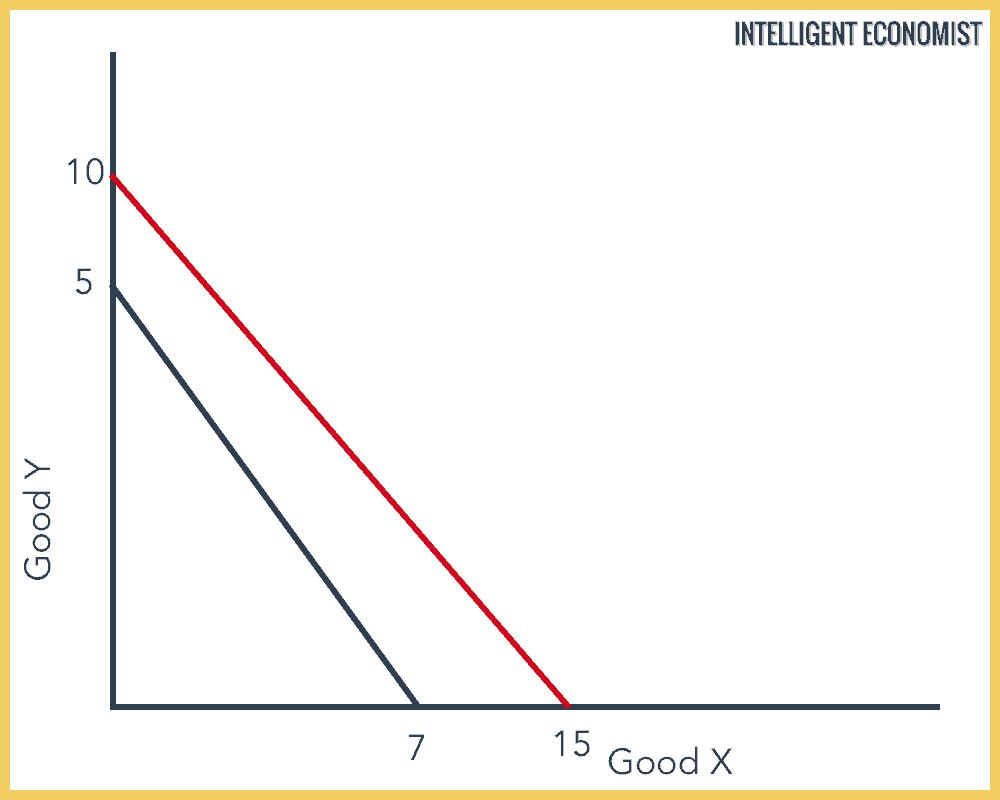

Here is a very simple example of how the law of comparative advantage functions. (To be clear, in the real world, things are much more complicated and less straightforward than this, so we’re simplifying for clarity.) In the diagram below, we have two countries: Red and Black country. These two countries can each produce two goods: Good X and Good Y.

Red Country has an Absolute Advantage over Black Country in producing both goods, but since their production possibility curves don’t meet, their costs are different, and there is room for specialization. Red should specialize in Good Y, and Black should specialize in Good X.

For Red, 1 unit of Good X ‘costs’ 5/7 or 0.71 units of Good Y, while for Black, 1 unit of X ‘costs’ 0.67 units of Good Y. Consequently, it is cheaper for Black to produce Good Y than it is for Red to produce the same good. Likewise, we can calculate that Red has a comparative advantage in creating Good Y.

An Everyday Comparative Advantage Example

Let’s also consider how comparative advantage can manifest in the life of an everyday person. For instance, let’s say you are a skilled engineer and also a great chef.

When you’re deciding which of these career paths would be more lucrative, you’ll have to consider which of the two options has a higher opportunity cost. Because being an engineer almost always pays better than being a cook, the comparative advantage would be in engineering.

The opportunity cost of being a chef is higher, because of all of the missed earnings for each hour you spend in the kitchen.

Criticisms of Comparative Advantage

1. Returns

The model assumes constant returns to scale, whereas in the real world firms often see increasing returns to scale and economies of scale.

2. Mobility

It’s not possible to move factors of production so easily from one location to the other (when countries have to specialize in a particular good).

3. Costs

There are transportation costs that the model does not consider.

4. Perfect Competition

The model assumes perfect competition that doesn’t exist in reality. We often see oligopolies and monopolies.

5. Trade Barriers

There are trade barriers that prevent countries from efficiently using comparative advantage such as tariffs and quotas.

The Heckscher-Ohlin Model

The Heckscher-Ohlin Model describes the interaction of relative abundance of factors and relative intensity of their use in different production processes.

The model builds on David Ricardo’s theory of comparative advantage by predicting patterns of commerce and production based on the factor endowments of a trading region. The model essentially says that countries will export products that use their abundant and cheap factor(s) of production and import products that use the countries’ scarce factor(s).

Assumptions of the Heckscher-Ohlin Model

- There are only two factors of production – Land and Labor

- The amount of labor and land is fixed but it is allowed to vary across countries

- Countries can only produce two goods

- Production uses constant returns to scale technology and diminishing Marginal Product

- Technology for producing one product is more land-intensive than the other

- There are only two countries

- All markets are competitive

- Producers take prices and wages/rents as given

- Workers get competitive wages

- Landowners get competitive rent

Conclusions of the Heckscher-Ohlin Model

The exports of a capital-abundant country will be from capital-intensive industries, and labor-abundant countries will import such goods, exporting labor-intensive goods in return. Competitive pressures within the H–O model produce this prediction fairly straightforwardly. Conveniently, this is an easily testable hypothesis.