Inflation is the sustained increase of the price level. The rate of inflation is the change in general price levels over a period. When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in purchasing power per unit of money.

Inflation vs. Deflation

The opposite of inflation is deflation, wherein prices decrease rather than increase. It happens when asset bubbles burst. Deflation is a significant problem because it can be the difference between a recession and a full-blown depression. For instance, deflation occurred at an annual rate of 10 percent during the Great Depression in the U.S. Problematically, deflation is also more difficult to reverse than inflation.

Why Does Inflation Matter?

Inflation is significant because it causes each unit of currency to have less purchasing power. This means that consumers are forced to spend more on goods and services, and the cost of living increases as time goes on. When the cost of living increases, people can afford fewer of the things they want and need, and their standard of living declines as well. In the United States, for example, the dollar has less value than it did in the past thanks to inflation.

Measuring Inflation

A year is chosen as the base year and this year has a value of 100, while subsequent changes over the years are expressed as a percentage change in the base year. Weighing the average price of a basket of goods that a typical household in that country buys measures the price index. Economists refer to this as a “market basket.” Since all goods aren’t of equal value to the consumer, i.e. food vs. mobile phone, a weight is assigned to each good by calculating the proportion of the price of the good to the total expenditure.

Different countries use different measures of inflation; in North America, there are two main price indexes:

1. Consumer Price Index (CPI)

A measure of price changes in consumer goods and services such as gas, food, clothing, and automobiles. The Consumer Price Index (CPI) measures price change from the perspective of the purchaser.

2. Producer Price Indexes (PPI)

A family of indexes that measure the average change over time in selling prices by domestic producers of goods and services. PPIs measure price change from the perspective of the seller.

The Inflation Rate

The inflation rate uses the change (decrease or increase) in prices over a set period of time (generally either a month or a year). The change in prices during that period is shown as a percentage. For instance, if the cost of a gallon of milk increases from $3.00 to $3.09 in the course of a year, the inflation rate for milk for that period has been 3 percent.

Misery Index and Inflation Rate

Along with the unemployment rate, the inflation rate is used to calculate the misery index. This index attempts to measure the financial health of everyday consumers. At higher than 10 percent, the misery index shows a situation of galloping inflation and/or recession (i.e. inflation or unemployment rates are at 10 percent or more).

How to Calculate Inflation Rate

You can easily calculate the inflation rate in the United States using the Consumer Price Index (CPI). To find the latest numbers for the CPI, visit the Bureau of Labor Statistics (BLS) website. The BLS calculates the CPI based on thousands of current prices throughout the United States.

Calculating Inflation Rate Example

We will use a very simple example to explain the process of calculating the inflation rate. We will state (extremely simplistically) that the index is based on one item—a loaf of bread—that cost just $1.00 in 1984, when the BS had the CPI at 100. At the beginning of 2006, that same loaf of bread would have cost $1.98 as the CPI had reached 198 at that point. We can look specifically at the difference in cost for the loaf of bread from 1984 to 2006.

Step 1: Calculate Increase in the CPI

As we know, the CPI was 100 in 1984, and had reached 198 by 2006. To calculate the difference, subtract the smaller number from the larger number. In this case, that means subtracting 100 from 198 to get 98. This means that during the period from 1984 to 2006, the CPI increased by 98 points. The next step is figuring out what this increase means.

Step 2: Compare the Increase in CPI to the Starting CPI

Divide 98 (the increase in CPI) by 100 (the starting CPI). That is 98 ÷ 100 = 0.98. Convert that number to a percentage, multiplying it by 100 to get 98%. Now we understand what the increase in CPI means—it is an increase of 98 percent from 1984 to 2006.

Applying This to Other Time Periods

You can use this process to calculate inflation over any period of time. For instance, if you’d like to know the inflation rate over the last five years, just calculate the increase in the CPI from five years ago to now (step 1 above), and then figure out what percentage increase that is (step 2).

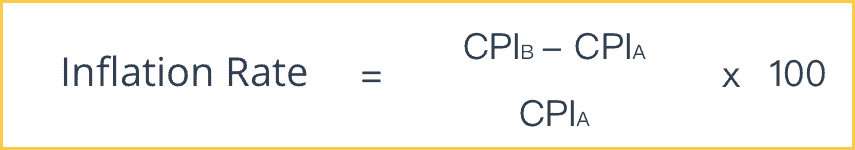

Inflation Rate Formula

To put it mathematically, here is the formula for calculating the inflation rate:

Inflation Rate = ((CPIB – CPIA) ÷ CPIA) x 100

In this formula, CPIA is the earlier CPI, and CPIB is the later CPI.

Problems with Measuring Inflation

1. Difficult to Assign

It is difficult to assign a basket of goods, because it has to be taken into account the need and consumption of all consumers in the country.

2. Substitution Bias

Since a weight is assigned to a good, an increase in that good’s price might increase inflation, but in reality, consumers might move to a substitute good. This is known as ‘substitution bias.’

3. Time Lag

New goods take years to enter the ‘basket of goods.’

4. Quality Bias

Sometimes there might be an improvement in the quality of the product, but it may be slightly more expensive than the cheaper lower quality product, which will last less longer, making it relatively more expensive. Thus, the cheaper product may overestimate inflation. This is known as “quality bias.”

Forms of Inflation

Inflation occurring in different contexts and to differing degrees is labeled and categorized differently:

1. Asset Inflation

When assets in areas such as stocks, gold, oil, housing, food, and so forth increase in price, this is called asset inflation. Experts do not often consider asset inflation to be a problem in periods when general inflation is not high. But asset inflation can certainly be harmful to the economy. For example, the international financial collapse created by the subprime mortgage crisis demonstrates the potentially serious threat posed by severe asset inflation.

2. Wage Inflation

Workers’ pay increasing more quickly than their cost of living is known as wage inflation. It can occur in the following contexts:

- When workers have control of their own pay

- When labor unions are able to negotiate for increasingly high wages

- When there is a labor shortage—demand is higher than supply so workers can charge more for their labor (this happens when the unemployment rate drops below 4 percent)

Wage increases are beneficial to workers and increase their quality of life. A downside is that they can contribute to cost-push inflation, thereby increasing the cost of goods and services and thus the cost of living.

3. Stagflation

Stagflation is inflation that takes place during a recession. This form of inflation involves high inflation in addition to high levels of unemployment and minimal economic growth. It is an abnormal occurrence in that inflation does not typically occur when growth is slow, because minimal economic growth should minimize inflation.

Stagflation will, however, arise as a result of government policy that interferes in the normal operations of the economy. More specifically, it can occur when the government/central banks apply constraints to supply while enlarging the money supply, as well as instituting other policies that slow economic growth (e.g. certain forms of taxation). Stagflation requires such unique circumstances to occur that it is not likely to occur in the future.

4. Core Inflation

Core inflation is the increase in the price of all goods/services but energy and food. Gas prices increase each summer as more people go on vacation and use more energy to do so. With higher gas prices come higher costs for transportation, and thus higher food prices. The Fed bases its monetary policy off the core inflation rate in order to avoid the factor of gas prices, in order to avoid having to change interest rates when gas prices increase.

Various Speeds of Inflation

There are four categories for different speeds of inflation, listed here from slowest to fastest:

1. Creeping Inflation

Also known as mild inflation, creeping inflation involves price increases of up to 3 percent annually. The Federal Reserve states that inflation of around 2 percent or lower is actually good for economic growth, and aims to maintain inflation at around 2 percent. Minimal inflation increases demand by giving consumers the impression that they should buy now, in order to avoid higher costs for goods and services in the future. This supports the overall growth of the economy.

2. Walking Inflation

Walking inflation is more of a problem for the economy and, by extension, for consumers’ quality of life. It entails annual inflation rates of 3 to 10 percent. At this level, inflation actually causes excessively rapid economic growth. Concerned about future costs of being too high, consumers buy goods and services in excess. This means demand is so high that firms cannot produce enough of the goods and services needed to meet it. Quality of life declines because necessary goods/services are more expensive than many can afford.

3. Galloping Inflation

At rates equal to or greater than 10 percent, inflation is categorized as “galloping” and causes major economic problems. Money becomes less and less valuable, such that income for both businesses and employees cannot meet necessary costs. Economic issues are exacerbated further by a lack of capital as foreign investment declines—investors do not want to deal with such an economic situation and will avoid it if possible.

4. Hyperinflation

Hyperinflation is an extreme form of inflation. It describes a situation in which the inflation rate is greater than 50 percent over the course of just one month. Hyperinflation is almost always caused by governments printing more currency to keep up with the cost of war. It inevitably causes major problems throughout society as a whole. Although this form of inflation is quite uncommon, it has occurred on some notable occasions:

- United States Civil War in in the 1860s (it has not happened in the U.S. since then)

- 1920s Germany

- Zimbabwe in the 2000s

- Venezuela in the 2010s

What Causes Inflation?

1. Demand-Pull Inflation

Demand-pull inflation is a more common cause of inflation. It occurs when demand for goods/services is greater than their supply. Because consumers have such high demand for these products, they will pay more for them and this drives up the prices.

2. Cost-Push Inflation

Cost-push inflation is a less common cause of inflation. This happens when demand remains steady while supplies are limited due to an external reason. For example, if the infrastructure to transport energy to a given area is damaged due to a natural disaster, the demand for energy will remain the same while supply declines. This will naturally drive up the price of energy.

3. Built-In Inflation

It is not always categorized as such, but built-in inflation can be considered a cause of inflation. It has to do with the fact that people believe inflation will continue to occur in the future. Workers generally think that as prices increase, wages will increase as well. However, with higher wages for workers, production costs also increase, leading to even higher costs for goods and services. This creates a feedback loop that can eventually culminate in a wage-price spiral.

A Flawed Explanation: Increase in the Money Supply

Although some say that a growing money supply leads to inflation, it’s not that simple. These sources are misunderstanding monetarism. It states that the main source of inflation is the government printing too much money, which itself leads to demand-pull or cost-push inflation. While increasing the money supply can lead to inflation in some scenarios, it is not the sole determinant. Factors such as the velocity of money, overall demand, and supply constraints also significantly influence inflation.

Costs of Inflation

1. Market Uncertainty

It increases uncertainty in business decision-making and could make investments less profitable. Thus, investment decreases and, as a result, growth and employment may fall too.

2. Exports

Exports become more expensive, so they become less competitive abroad and as a result net trade may decline.

3. Households

Households experience a fall in purchasing power, which reduces quality of life for the average person.

4. Distortion

There is a distortion in the market because of relative price changes.

5. Inequality

It results in further inequality of distribution of wealth and income as the poorer have fewer options against inflation and limited borrowing capability.

6. Lenders

If inflation is higher than expected, then lenders lose as the money they get back is worth less than the money they lent.