The marginal propensity to consume (MPC) is the increase in consumer spending due to an increase in income. This can be expressed as ∆C/∆Y, which is a change in consumption over the change in income.

For example, if a person earns an extra $10, and then spends $7.50 from the $10, then the marginal propensity to consume will be $7.5/10 = 0.75.

MPC values will always range from 0 to 1. If a person’s entire increase in income is consumed, then the change in consumption (∆C) will be equal to change in income (∆Y) making MPC = 1. In case that the entire income is saved, change in consumption is zero meaning MPC = 0.

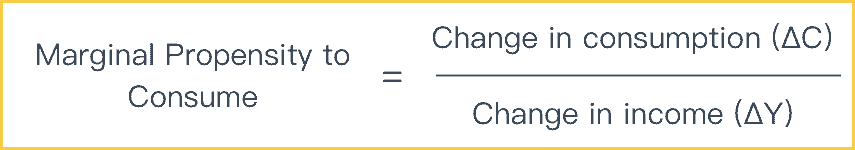

Marginal Propensity to Consume Formula

The Marginal Propensity to Consume formula can be expressed as ∆C/∆Y, which is a change in consumption over the change in income. Additionally, MPC is the inverse of the Marginal Propensity to Save.

Marginal Propensity to Consume Example

For example, if an individual receives a $1,000 bonus on top of their normal annual salary. Now they have an extra $1,000 to spend that they didn’t before. Suppose, the individual decides to spend $750 of that $1,000 on a vacation, then his or her Marginal Propensity to Consume will be 750/1000 = 0.75

If the individual saves the entire $1,000 then his/her MPC will 0 and if he/she spends the entire $1,000 then their MPC will be 1.

We can also plug in the Marginal Propensity to Consume formula to come to the same answer.

For example, if an individual is making $100,000 a year and they get an increase of $10,000 as a bonus, then his total income will be $110,000. The change in income (∆Y) = New Income – Old Income = $110,000-$100,000 = $10,000

Let’s say that he previously spent $75,000 of his income and with the increase, he decides to spend another $5,000 more. Then his change in consumption (∆C) will be $5,000.

Therefore, Marginal Propensity to Consume (MPC) = ∆C/∆Y = 5000/10000 = 0.5

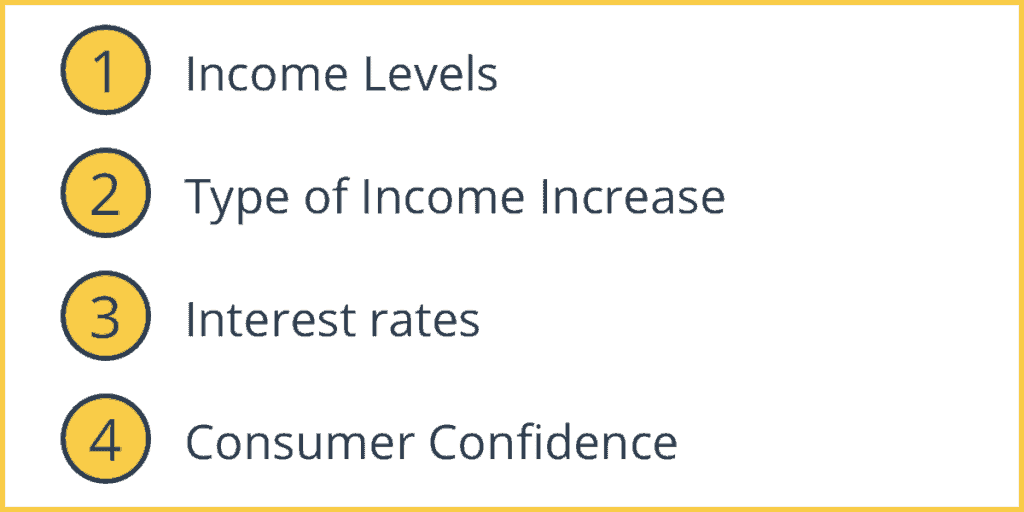

Marginal Propensity to Consume Factors

1. Income Levels

If an individual has a low income, an increase in his income will have a larger percentage increase in income than that of a wealthier person. For example, if Person A is earning $1,000/month and Person B is earning $10,000/month then a $1,000 increase in income will be 100% for Person A and only 10% for Person B.

This also means that at the lower income levels, individuals have to use up most of their income to purchase the same amount of goods while high-income individuals can save more since they have most of the goods they need.

2. Type of Income Increase

If the individual receives a bonus (which is a temporary increase in income), then they may be more inclined to save. However, if they gain a permanent increase in income, they are more likely to spend it.

3. Interest Rates

A higher interest rate may encourage people to save rather than consume. However, with higher interest rates individuals can increase their income through saving and thus increase consumption.

4. Consumer Confidence

If consumer confidence in the economy is high, then people are likely to spend. If people are pessimistic (e.g., expect unemployment/recession), then they will tend to delay spending decisions. This will lower the MPC.

Hi Prateek,

In the Marginal Propensity to Consume Example, you stated “Therefore, Marginal Propensity to Consume (MPC) = ∆C/∆Y = 5000/10000 = 0.2”.

5000/10000 = 0.5, not 0.2.

Thank you for your clear article otherwise!

Thanks for pointing that out Josh. I’ve updated it