Market Failure occur when there is a misallocation of resources, which results in distortions in the market. This distortion creates an inefficiency in the market. There are four probable causes of market failures; power abuse (a monopoly or monopsony, the sole buyer of a factor of production), improper or incomplete distribution of information, externalities and public goods.

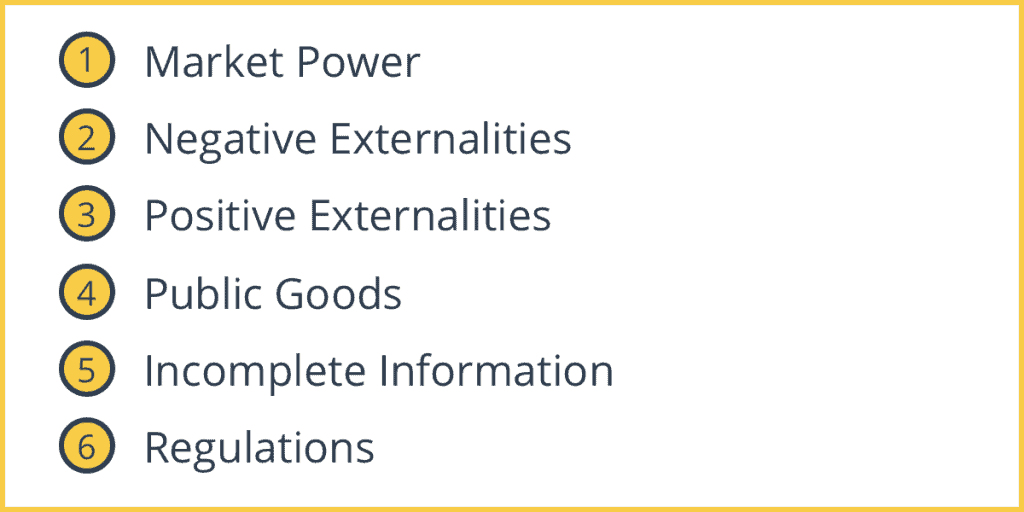

Types and Causes of Market Failures

1. Market Power

When there is only one buyer or seller in the market, that firm can set the price of the product or the quantity supplied. Many countries have a limit on how much market share one firm can have or how big they can become.

2. Negative Externalities

Negative Externalities occur when the production or consumption of a good or service causes the social cost to exceed the private cost. For example, the production of wood furniture does not take into account the effects of environmental pollution or deforestation.

3. Positive Externalities

Positive Externalities occur when the production or consumption of a good or service causes the social benefit to exceed the private benefit. For example, if the government provides vaccines to everyone for free, then there is a social benefit that the country benefits. These benefits are not considered in production costs.

4. Public Goods

These are goods that can’t exclude people, i.e., if it’s produced, then anyone can consume it, and one person consuming the good doesn’t decrease the availability of the good for someone else. For example, street lights or lighthouse are examples of public goods. Public goods cause a market failure because people don’t reveal their true preferences for what they want. People know that they will get it for free and someone else can pay. So the government usually ends up producing the good. This effect is known as the ‘free-rider problem.

5. Incomplete Information

One party has material information that the other does not, or both parties lack material information that would affect whether or not the trade occurs, or for what price it occurs. For example, used car sellers – the seller probably knows more about the car and has an incentive to cheat; such asymmetry can lead to distortions in the market. This problem is known as asymmetric information.

6. Regulations

Restrictions such as price floors or price ceilings prevent the price mechanism from efficiently allocating resources. For example, minimum wage laws are price floors. Employees can’t be paid less than these set minimums.

I was wondering where you would place these:

Pecuniary externalities

Merit goods

Tragedy of the commons