Whether positive or negative, externalities are the effects of a good’s consumption or production on third parties; these effects are not accounted for in the price of said goods. Externalities are otherwise known as “spill-over effects.”

Positive externalities are the benefits experienced by these third parties as a result of consumption or production; in contrast, negative externalities are the harms to those third parties. Because positive externalities are primarily beneficial to society as a whole, they are to be promoted whenever possible.

Private vs. Social Benefits

The two key forms of benefit in the context of positive externalities are private and social benefits. Here’s what those terms mean:

- Private benefit: The private benefit is the benefit received by an individual or a firm by consuming and producing a good respectively.

- Social benefit: The social benefit is the total benefit to society from an economic activity, whether production or consumption.

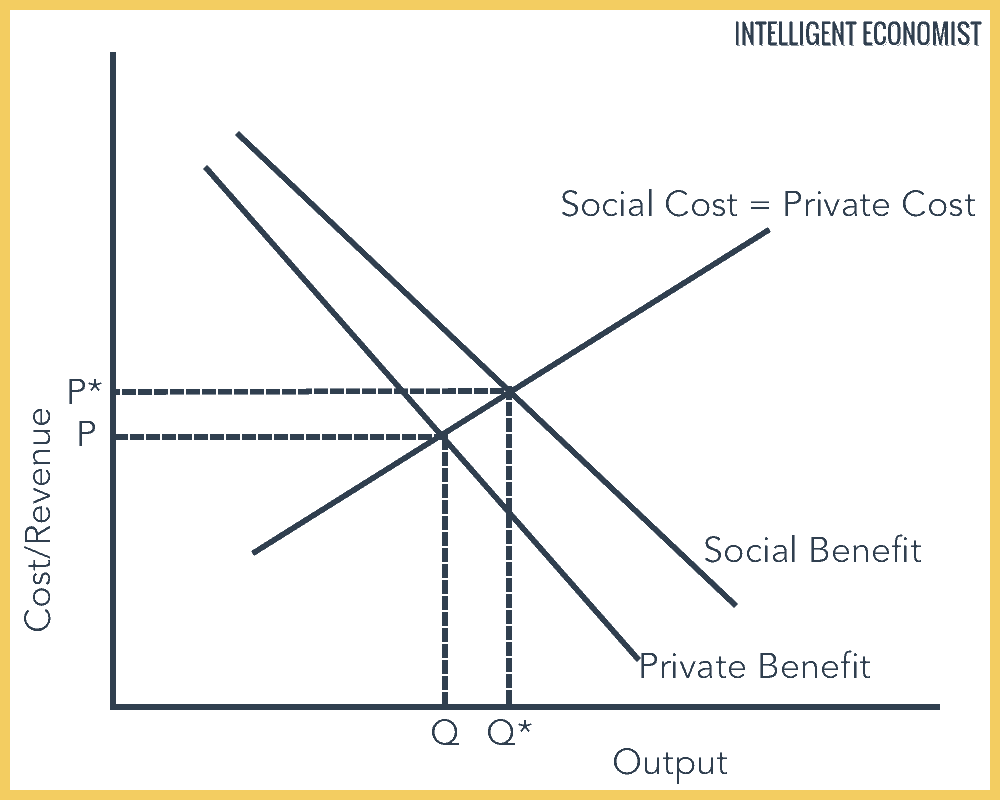

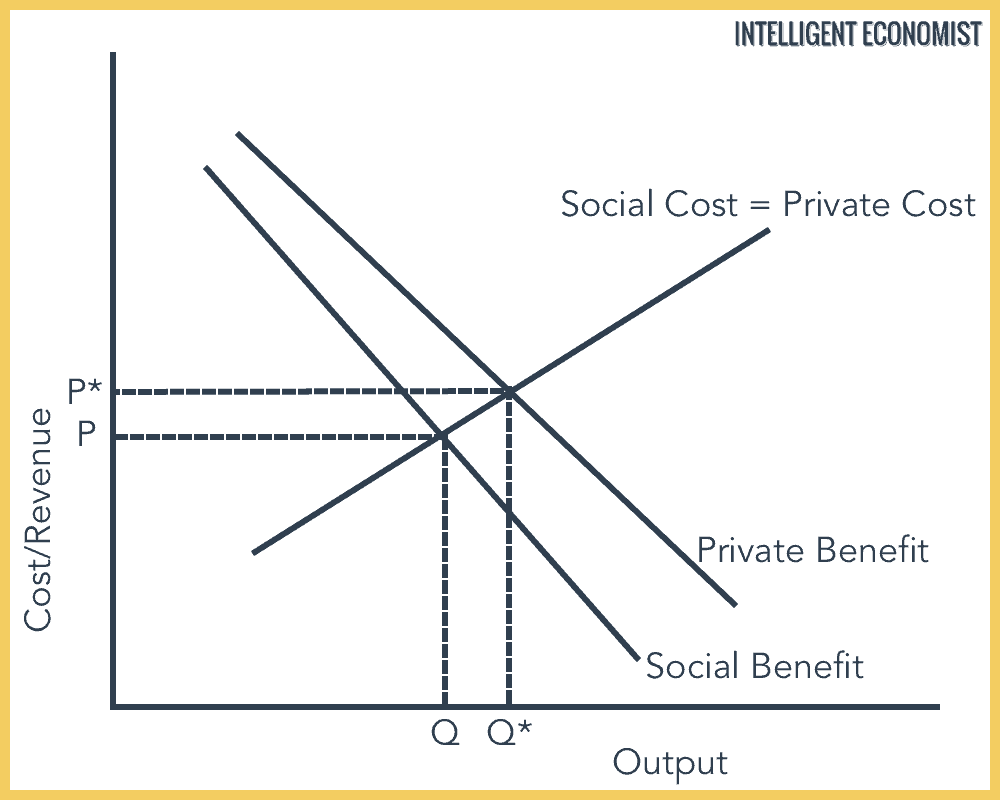

This is important to note because, in the case of positive externalities, social benefits are greater than private benefits: Social Benefit > Private Benefit.

Types of Positive Externalities

Positive externalities can be produced through consumption as well as the production of goods:

Positive Externalities of Consumption

When the consumption of a good results in social benefits being greater than private benefits, these are positive externalities of consumption. These types of goods are generally under-consumed because people do not typically take into account the external benefits of their consumption choices; this also causes these goods to be under-produced.

The optimal consumption should be Q* at P*, but it’s at Q at P.

Positive Externalities of Production

When the production of a good produces social benefits that are greater than its private benefits, this is associated with positive externalities of production. Because these goods are typically under-produced by default, they are also under-consumed.

The optimal production should be Q* at P*; instead it is Q at P.

Examples of Positive Externalities

Here are a few examples of this phenomenon to help you understand how it actually functions in the real world:

- A vaccination drive in your neighborhood: This reduces the chance of your getting infected with a disease. Of course, the fact that you are less likely to get ill is a private benefit for you, but it also creates social benefit because those around you are less likely to catch a disease as well if you don’t have it. When a large percentage of the total population has been vaccinated, those who are not vaccinated are protected because there are too few vulnerable individuals for the disease to be able to spread.

- A farmer landscapes his land: Doing so benefits him (this is the private benefit), but because it makes the countryside better to look at, it also makes things more pleasant for everyone and increases the value of all nearby properties (this is the social benefit).

- Beekeeping: Beehives produce honey for the beekeeper, which the beekeeper can sell for a profit. The positive externality here is the fact that bees will inevitably also pollinate nearby fields and farms, which will increase those farmers’ yields.

Strategies That Encourage Positive Externalities

In general, because positive externalities benefit society as a whole, they are widely understood as something to encourage. Here are a couple of the most common government policies that work to perpetuate positive externalities:

1. Subsidies and grants

Subsidies are a form of support given to producers that help to reduce the cost of production of a particular good by effectively paying for part of the production cost. This creates a higher supply of those goods and, because it lowers the price of the good for consumers, consumption of these socially beneficial goods generally increases. Goods that governments want to increase the consumption of, i.e. those that produce positive externalities, are subsidized.

Additionally, public goods include necessary infrastructure like bridges and roads that produce positive externalities. In general, their construction and maintenance are largely funded by the government using tax dollars. Likewise, governments can use tax revenue to subsidize (or even make completely free) things like college education, thereby encouraging more youth to go to college. In this example, the positive externality is the overall future benefit to society of a more educated populace.

2. Positive Advertising

Although the effectiveness of this strategy is secondary to that of subsidies, governments can encourage positive externalities of consumption using positive advertising. Such advertising works to educate the public so as to promote the consumption of goods that are socially beneficial.