The real interest rate is found by adjusting a standard interest rate so that the effects of inflation are not present. This allows you to understand the interest rate better by revealing the true yield of lenders and investors as well as the true cost of funds for borrowers.

In other words, it shows the true rate of loans and bonds. Calculating the real interest rate involves subtracting the rate of inflation (whether expected or actual) from the more straightforward nominal interest rate (described in more detail below). When the actual rate of inflation is not known, real interest rates are predictive.

The World Bank has a page containing the real interest rates for most countries.

Time-Preference Theory of Interest

The real interest rate is a representation of how much individuals favor current goods rather than goods in the future. If a borrower is choosing to use funds now they are prioritizing current goods above future goods, or showing a greater time-preference for current goods; they are thus prepared to take out a loan with a higher interest rate. Meanwhile, lenders who wait to spend funds until the future are demonstrating a lower time-preference and can loan at a lower rate of interest.

Real Interest Rate Formula

The basic formula is as follows:

Real Interest Rate (R) = Nominal Interest Rate (r) – Rate of Inflation (i)

The more precise and mathematical formula is:

(1+ (R)) = (1+ (r)) / (1+ (i))

This means that when the rate of inflation is zero, the real interest rate is equal to the nominal interest rate. With positive inflation, the nominal interest rate is higher than the real interest rate. Effectively, the real interest rate is the nominal interest adjusted for the rate of inflation. It allows consumers and investors to make better decisions about their loans and investments.

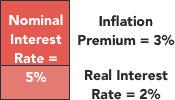

Example: If the rate of inflation is at 3%, and the real interest rate is 2%, then the nominal interest rate would be 5%.

Rate of Inflation

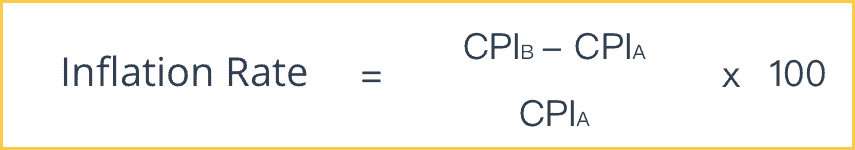

Since calculating the real interest rate requires you to know the rate of inflation, it’s important to understand this as well. The rate of inflation describes how much the cost of goods/services will increase in a particular year.

Here is the formula for calculating the rate of inflation:

CPIX refers to the “initial consumer price index,” meaning the previous year’s consumer price index.

Difference Between the Real & the Nominal Interest Rate

The difference between the real and nominal interest rate is that the real interest rate is approximately equal to the nominal interest rate minus the expected rate of inflation. The nominal interest rate in the interest rate before inflation has been accounted for and removed from the number. Investors and lenders are typically concerned with real interest rates.

Nominal Interest Rate

The nominal interest rate is the simplest type of interest rate. It is the stated interest rate of a given bond or loan. The nominal interest rate is in the actual monetary price that borrowers pay to lenders to use their money. For instance, if the nominal rate on a loan is 5%, then borrowers can expect to pay $5 of interest for every $100 loaned to them. But the nominal interest rate doesn’t take inflation into account.

Real Interest Rate

To continue the example, now imagine that the inflation rate was 5%. A 5% inflation rate means that an average basket of goods you purchased this year is 5% more expensive when compared to last year. Continuing with our previous example, the lender would make nothing if he loaned it out at 5% when the rate of inflation was 5%.