Introduction to the Stock Market

A stock market (also known as an equity market or share market), is a collection of buyers and sellers of stocks. These stocks represent ownership interests in companies. These may include publicly or privately traded securities. The New York Stock Exchange (NYSE) is an example of a share market.

Usually, large companies will list their stock on a stock exchange because it makes their shares more liquid (i.e., easy to buy and sell), which investors love. This liquidity also attracts international investors.

As of 2017, the Global Stock Market is now worth a record $76.3 Trillion. The NYSE has a market capitalization of roughly $21 trillion and is the largest stock market in the world.

What is A Long Position?

In a long position, the owner benefits when the stock or share gains in value. The potential profit is unlimited. So the “long” position is said to be “bullish.” When the stock is down, the most that the owner can lose is the amount of money he has originally paid for it. Since it is impossible to lose more, it is said that the owners have “limited liability.”

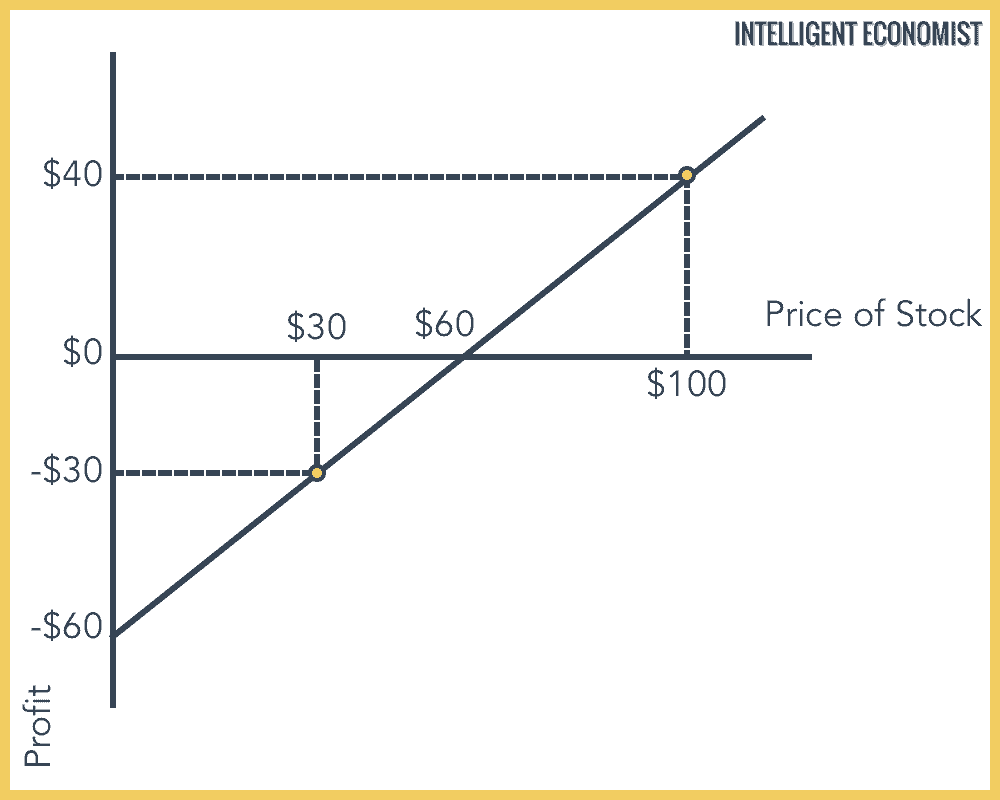

Long Position Example

Suppose a share is purchased at $60 if the share value doesn’t change the owner’s profit will be $0. If the share grows in value up to $100, the owner’s profit is $40. If the share price drops to $30, the owner’s loss will be $30.

In Short Selling the borrower borrows one stock from an owner in exchange for an IOU and then sells it to a buyer. When the market value of the share is down, the borrower buys it and returns to the original owner.

Say for example that a short seller borrows 1 GM Stock from the owner in exchange for the borrower’s IOU. The borrower sells 1 GM share to a buyer for $60. If the market value of 1 GM drops to $50, the borrower gets $10.

This way the person, who is in the “short selling” position, gains a profit when the share price drops in value. The maximum profit is equal to the amount the share the investor originally paid. However, the maximum potential loss can be unlimited. That’s why short selling is considered to be “bearish.”

What is a Short Position?

In a short position, the investor expects that the price of the stock will decrease in the short term. To set up a short sell transaction, the investor borrows the shares from an owner and then sells it to another investor. The investor must ultimately return the stock he borrows. The investor is borrowing and selling the stock at a high price and then later buys the stock from the market when the price falls. He then returns the stock to the owner.

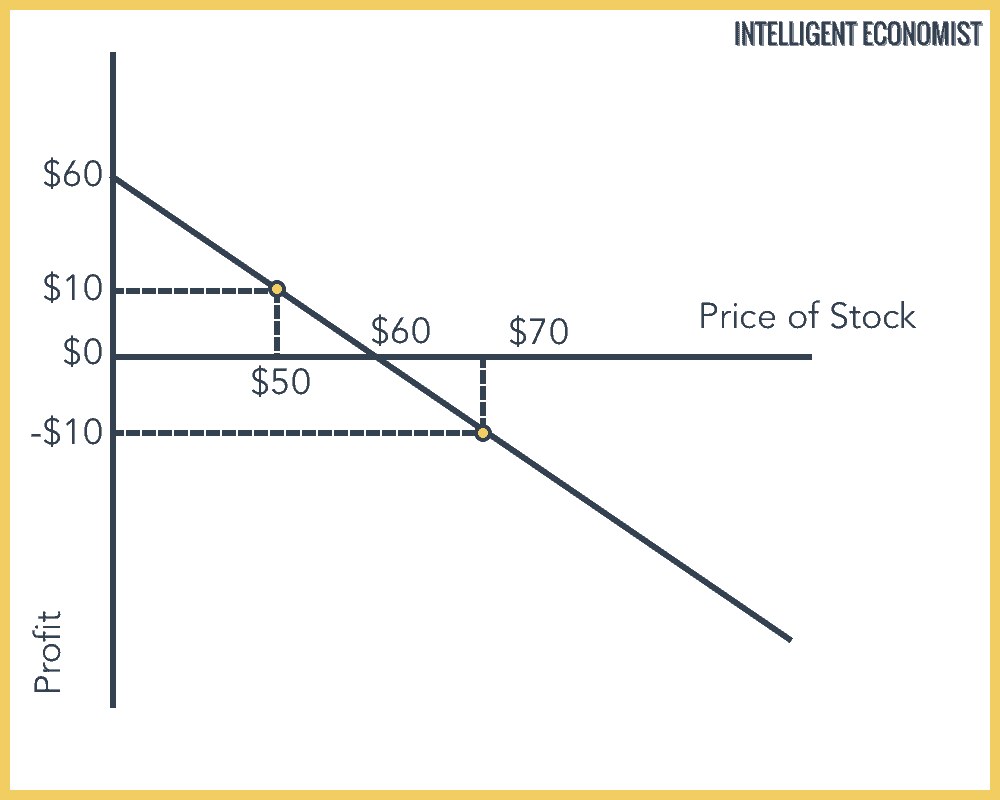

Short Selling Example

Suppose the borrowed share has a present value of $60; if the share price doesn’t change, the short seller’s profit will be $0.

However, if the borrowed share’s price goes up in value up to $70, the short seller’s loss will be (-$10).

If the borrowed share’ price drops in value up to $50, the short seller will make a $10 profit.

Questions about the Stock Market

1. Why lend stock?

There’s no reason not to, its convenient and is as good as an IOU. However, when you lend you lose your voting rights. When you short sell, the short seller gives the owner of the stock an IOU of the same share.

2. How long does a short position last?

A short position lasts until the two parties agree. The investor is required to return the borrowed shares back to the lender at some point in the future. The lender also has the right to call back the shares from the borrower at any time, with minimal notice. In such a situation, if one side wants to leave, then the broker re-matches the deal.

3. Who has voting rights in a firm?

The person who is in physical possession of the stock certificate.

4. How does the firm know who to pay the dividend?

If a company pays out a dividend and the owner has lent the share, then the person who has borrowed the stock has to pay the actual owner. Also, ownership is tracked by a transfer agent.

5. What is the rate of return for a short seller?

The short seller gets cash (interest) and has to pay dividends. So, the rate of return = interest received – dividends paid.

6. What is a short squeeze?

For example, there are 1 million genuine shares and 2 million IOU’s (hypothetical shares). If the stock owner demands all 2 million IOUs at once, then the short seller has to buy 1 million shares, which increases the price of the share and the short seller loses.

7. Does the short seller pay interest on the borrowed stock?

The short seller doesn’t pay interest on the borrowed stock. However, actual interest is disguised as a trading fee.

8. What the effects of short selling on stock price?

Short selling has no effects on the price of the stock.

9. What is the impact on stock price with the issuance of new stock?

There is no effect on the stock price when new stock is issued.

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include securities listed on a public stock exchange, as well as stock that is only traded privately, such as shares of private companies which are sold to investors through equity crowdfunding platforms. Investment is usually made with an investment strategy in mind.