Supply Side Economics involves policies aimed at increasing aggregate supply (AS), a shift from left to right. They are based on the belief that higher rates of production will lead to higher rates of economic growth.

They are aimed at enhancing the productive capacities of an economy by fostering what they view as a better business climate via deregulation and tax cuts, which creates more jobs, thereby creating higher levels of demand and increasing economic growth. They focus on improving the quality and quantity of the four factors of production (i.e. labor, capital, land, and entrepreneurship).

Successful policies lower the natural rate of unemployment. Some economists also believe that successful supply-side policies can contribute to long-term economic growth without increasing the rate of inflation. It’s important to note that supply-side policies are not perfect: they are difficult to implement, they are unpopular, and they take a great deal of time to take effect.

The Three Supply-Side Pillars

1. Regulatory policy

Advocates for supply-side economics prefer less government intervention in the free market (the typical laissez-faire, small government perspective of conservatives). This is because they don’t believe that creating demand via government policy will actually create real economic growth.

2. Tax policy

Supply-side economists advocate for decreased marginal tax rates as well as lower income tax that will spur workers to choose to work more. They also believe in lower capital gains taxes because they think this will encourage investors and entrepreneurs to apply their ample capital in a way that generates economic growth.

3. Monetary policy

Monetary policy is the practice of increasing or decreasing the number of dollars circulating through the economy at a given time. The Federal Reserve can determine this quantity. Supply-side economists do not believe that monetary policy helps to manage the economy in a beneficial manner. Keynesian economists, by contrast, tend to argue for manipulating the money supply in order to improve growth and economic stability (there are more details on the contrast between these two economic perspectives later on in this article).

Supply Side Economics Examples

1. Labor Market

Lowering wages frees up the labor market, which makes a lower-paid job more attractive. To lower wages, the government takes measures like abolishing minimum wage laws, decentralizing trade union power, reducing unemployment benefits, lowering income tax, and making hiring and firing easier and more affordable for firms. However, these policies are very politically unpopular, so they may not be implemented in many cases, especially in societies where there are a strong labor movement and high rates of union membership.

2. Capital Markets

The government needs to create money for banks to lend for investment. The government can do this by increasing competition between banks to make loans more attractive, reducing financial crowding out, and making savings more attractive.

3. Entrepreneurship

The government needs to encourage entrepreneurs to start new businesses by lowering the marginal tax rate and encouraging share ownership among employees. Another commonly employed policy is not requiring new businesses to pay corporate taxes during their first three years, or if they don’t cross a minimum level of revenue during their initial years.

4. Competition and Efficiency

The government will need to increase competition between firms and increase the overall efficiency of the economy. They can do this by removing monopolies, by privatizing certain industries, by freeing up trade (through the reduction or even elimination of trade barriers), and by implementing inward investment policies.

5. Education

Better education and training to improve skills will improve labor productivity.

Impact of Successful Supply Side Economics

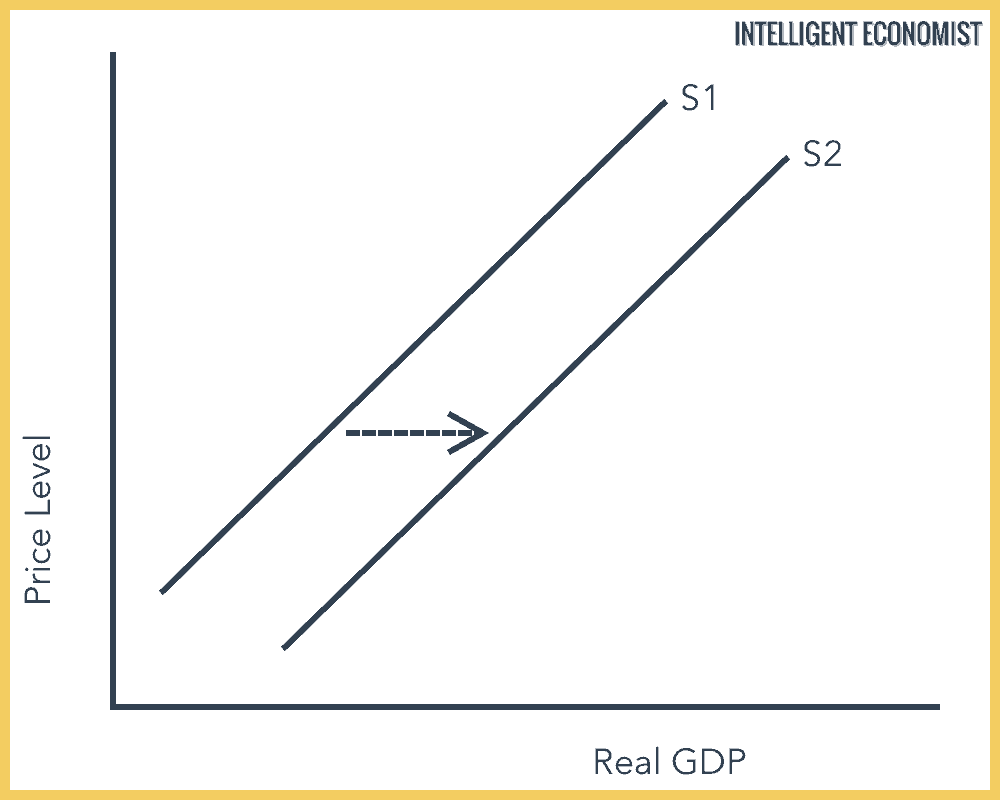

In the diagram below, we can see a shift in Aggregate Supply from S1 to S2, which demonstrates the impact of a successful supply-side policy.

1. Lower Inflation

Shifting Aggregate Supply to the right will result in a lower price level. By making the economy more efficient, supply-side policies help reduce cost push inflation.

2. Lower Unemployment

Supply-side policies can help reduce structural, frictional unemployment and real wage unemployment and therefore help reduce the natural rate of unemployment.

3. Improved Economic Growth

Supply-side policies can increase the sustainable rate of economic growth by increasing Aggregate Supply.

4. Improved trade and balance of payments

By making firms more productive and competitive, firms are able to export more goods and services.

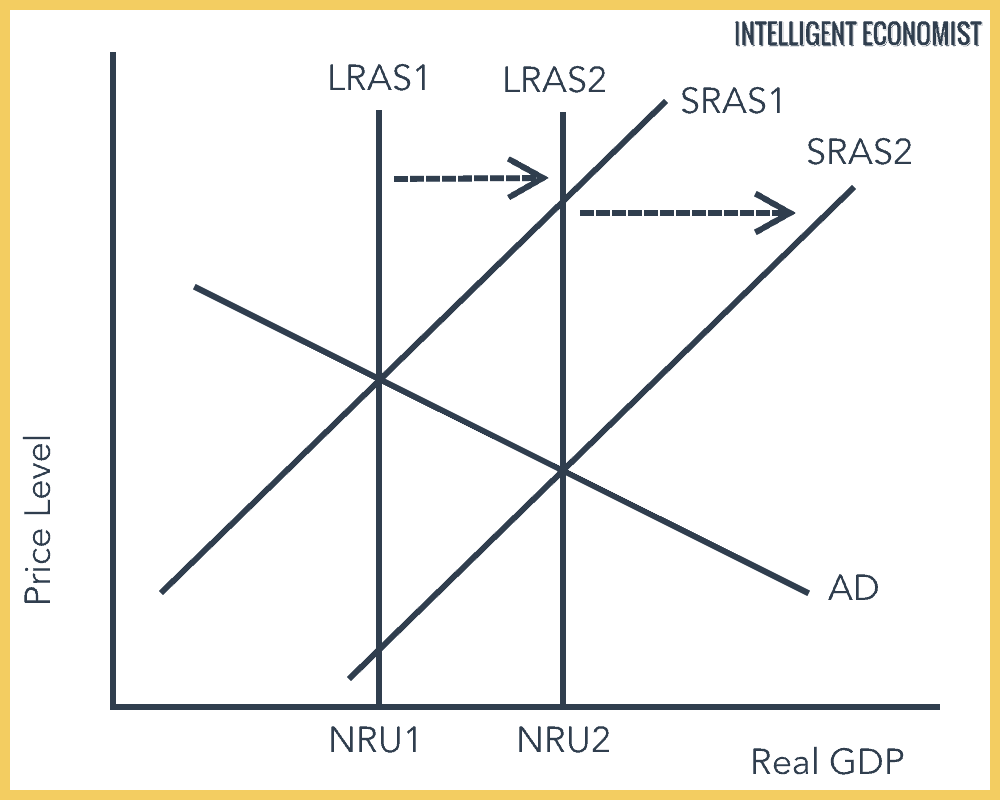

Long Run Effects of Supply-Side Economics

In the short run, supply-side policies will have an impact on the short-run aggregate supply (abbreviated as SRAS). They will cause a shift from SRAS1 to SRAS2 (an increase in aggregate supply). In the long run, this will result in an increase in aggregate supply from LRAS1 to LRAS2.

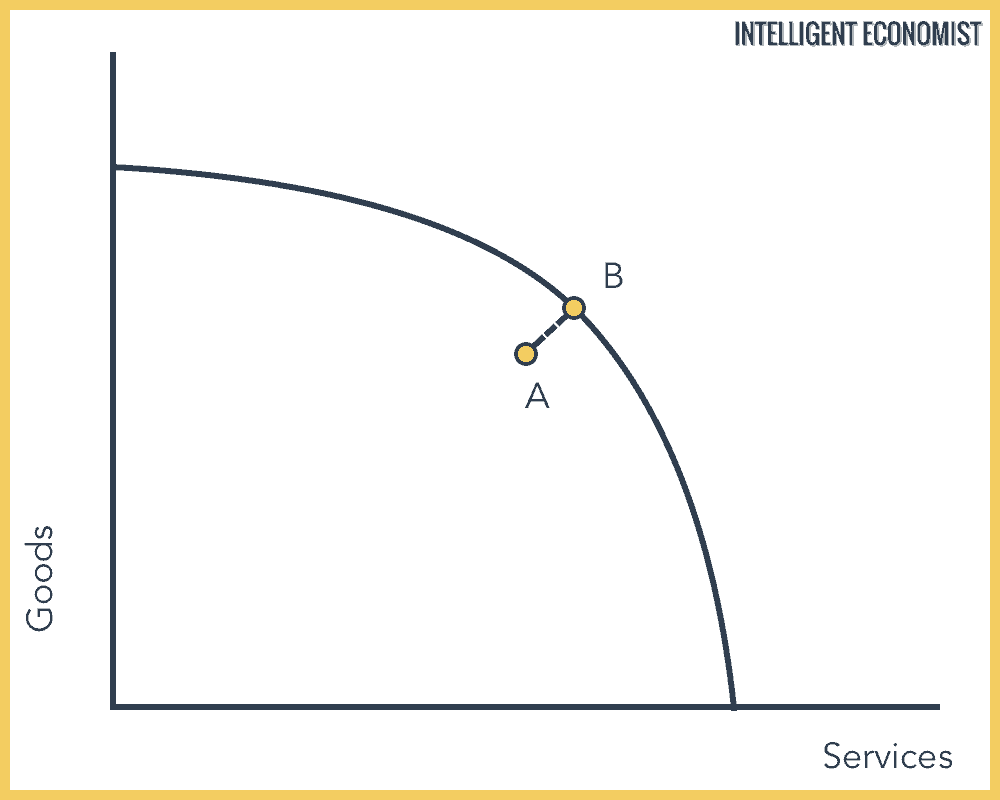

Production Possibility Curve with a Successful Supply Side Policy

In terms of a production possibility curve, it would shift capabilities from “A” to “B.” A production possibility curve represents a country’s available resources along with the maximum amounts of two goods produced from those resources.

Supply-Side Economics vs. Keynesian Economics

The central point of supply-side economics is that the most significant determinant element of economic growth is production (that is, the supply of products). This perspective is in opposition to Keynesian theory, which holds that if consumer demand drops and a recession occurs, then the government ought to intervene directly by creating monetary stimulus (increasing the money/credit supply) as well as fiscal stimulus (e.g. increasing government consumption.)

Keynesian economists advocate for policies like government investment in infrastructure, such as constructing and maintaining roads and bridges, which creates many jobs. In addition, they push for more widespread education and for the provision of unemployment benefits.

While Keynesian economists believe that consumers and consumer demand are the most important source of economic growth, supply-side economists argue that producers are the most important contributors to economic growth. They even believe that, for the most part, demand doesn’t matter. If there is a likely short-term instance of overproduction, argue supply-side economists, prices for that good or service will decrease and thus consumers will choose to purchase more of it.

Supply-Side Economics and Reaganomics

Reaganomics—the laissez-faire economic policy furthered by U.S. President Ronald Reagan—espoused many supply-side policies. The most famous of these is probably the “trickle-down” policy. This is the highly contentious, disputed idea that when you cut taxes for entrepreneurs and investors at the top tier of the economic strata, they are more motivated to invest their money, and the economic positives they create “trickle-down” to the rest of the economic strata below them.

Disadvantages of Supply-Side Economics

1. Time Lag

Most supply-side policies can take a long time to work and for the effects to be seen in the economy. For example, if the country wants to improve the quality of human capital through education and training, this will normally take years to complete and for the economy to reap tangible benefits, even if such investment is worthwhile.

2. Expensive

Supply-side policies can be costly to implement. For example, for the government to improve the quality of human capital, it will need to sponsor or subsidize education and training programs. These programs are highly labor-intensive and therefore extremely costly.

3. Unpopular

Many supply-side policies are politically unpopular, which means that they are unlikely to be implemented. For example, unions wield significant political influence in many countries, and they will oppose any negative labor market changes like breaking up unions or abolishing minimum wages.

Ccan you base it on actual History not your theories

Hoovers Trickle down and tax tariffs caused Great Depression

Reagan’s Supply Side created 10% unemployment in first term, took us from Creditor nation to a Debt nation then shut down VA funds, Mental Hospitals causing massive Homelessness and the RICH never came

Bush Jr’s Trickle down tax cuts caused the greatest Recession in History

Trumps Trickle down put 6 Trillion onto our Debt in 4 years while the Middle Class home owners saw one of the largest tax increases esp in Blue states in US history

It was Tip O’Neil who forced 11 Tax increases in Reagans 2nd term that caused job growth

We cant have an Alternative history because Republicans need their fake Reagan HERO .

Supply side comes out of the ashes of USSR and Jack Kemp knew the Rich would get richer as the poor were left on the street to die…..

Trickle down, Deregulation, Supply Side, Privatization of Govt its all PLUTOCRACY.

Clintonomics is working under Biden and creating the 4% unemployment and 7% GDP numbers and big Savings for working class because the US consumer is the Middle Class …….not the 1% Oligarchal Rich who keep our Tax Money each and every time the GOP does it.

You clearly have a limited grasp on the supply-side policies you cite as destructive. Remember, Congress ( which was under Democratic control in the above situations you cite) controlled spending. Not President Reagan. President Reagan only had the Senate for 2 years during his two terms, the Democratic party controlling both Senate & House during the 6 years of the years he was president. ALL spending comes out of the House, so don’t blame the Reagan administration for over spending problems. As to President Trumph, would you say President Biden’s policies are really working well today (February, 2022)? We had some of the lowest inflation and lowest unemployment rates in some 50 years under Trumph. You need to go back an reexamine your facts.