How Do Tariffs Work

A tariff is a type of trade barrier imposed by a government that acts as a tax on imports. The tariff may be in the form of a specific or ad valorem tax. Tariffs raise the price of imported goods to lowers their consumption. Tariffs encourage consumers to pick the local option.

A specific tax is imposed on each unit, i.e., $0.50 on a pack of cigarettes, while an ad valorem tax (or percentage tax) is a percentage of the price like a sales tax of 10%.

Generally speaking, most tariffs are a percentage of the value of the product. You can look up tariffs by product name at the United States International Trade Commissions website. The rates are broken down by the components and sizes of specific parts as well.

For example, the general tariff rate on an imported microwave oven is 2%.

Effect of Tariffs

Governments impose tariffs to discourage consumers from buying imported products by simply making them more expensive to purchase.

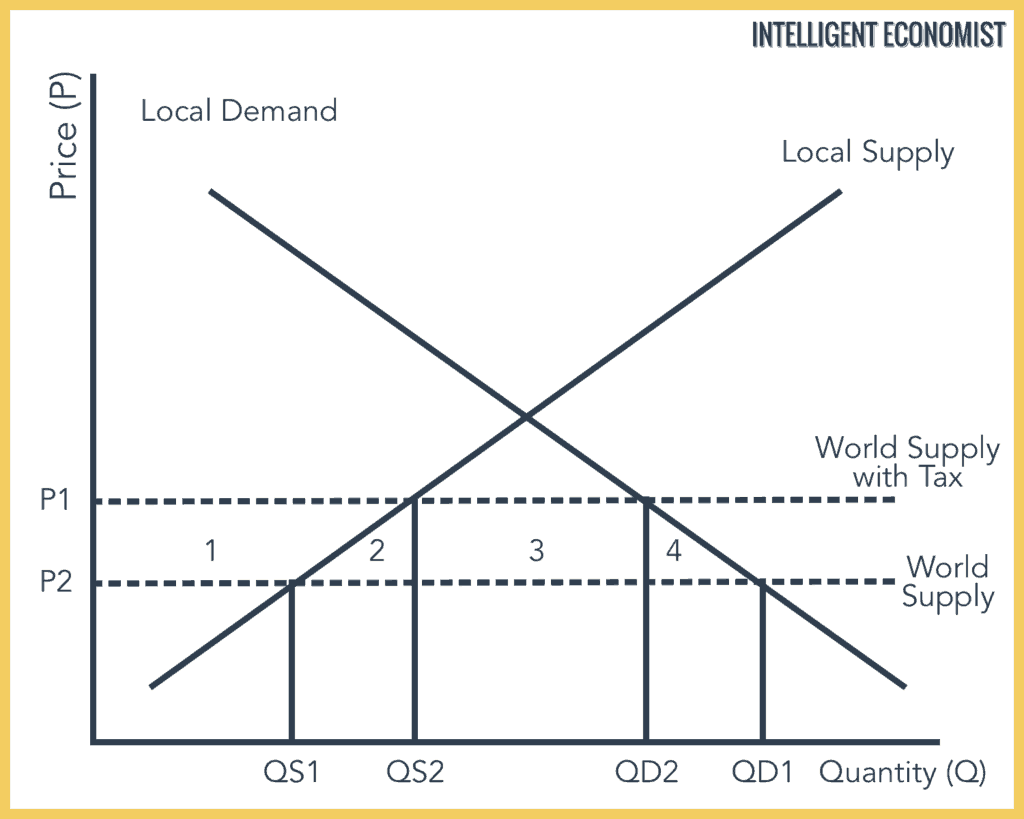

In the diagram below, you can see a Local Demand and Local Supply curve. The World Supply curve demotes imported goods. The World Supply curve is flat because it is assumed that the supply is infinite, in the sense that the world can infinitely supply this product to this one country.

Tariff Graph

The world price is P2 and at price P2, domestic consumption is QD1 and production is QS1. This point is the intersection of the world supply curve and the local demand and local supply curve. The quantity that is imported is the difference between QD1 and QS1.

With the tariff, the price becomes P1 (The intersection of the World Supply with Tax and the local demand and local supply curves). Domestic consumption decreases to QD2 and domestic production increases to QS2. The difference between QD2 and QS2 is the amount that is imported.

The difference between the two imported quantities is the change in quantity with the tariff. As we can see, the economy consumes more of the local good, and less is imported.

Consumer Surplus – decreases by area 1, 2, 3, 4

Producer Surplus – increases by area 1

Government Revenue – area 3

Therefore, the welfare loss is area 2 and 4 that comes from production inefficiency (since it costs the domestic company more to produce than the foreign firm) and consumption inefficiency (units aren’t consumed because of the increase in price) respectively.