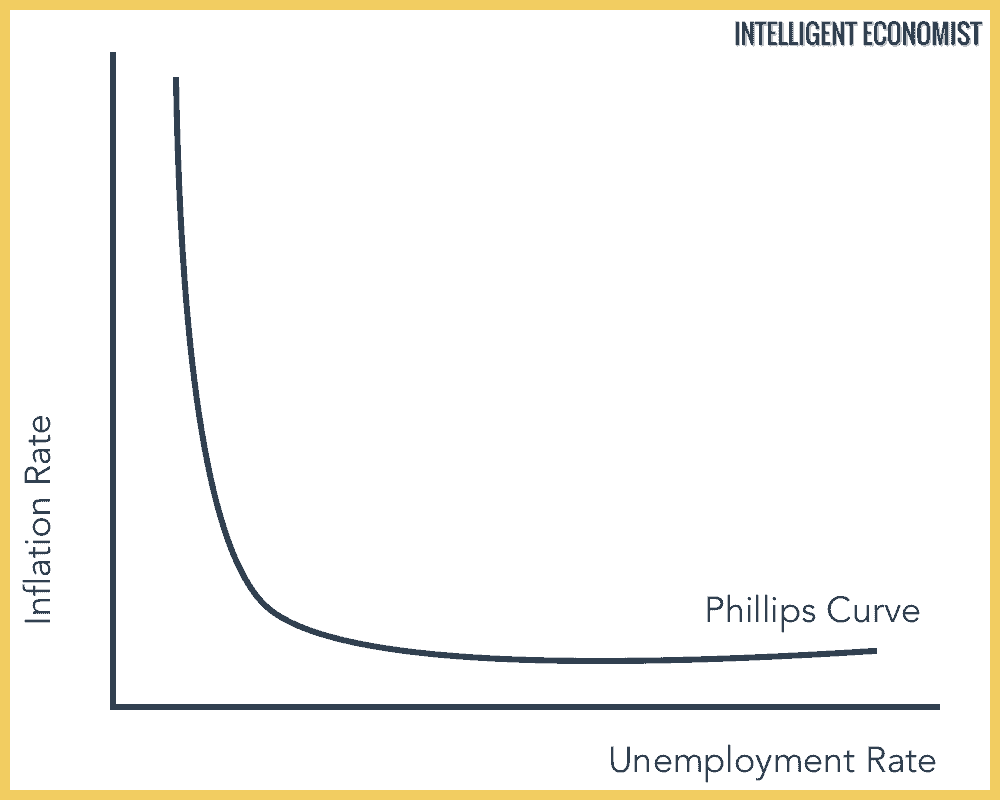

The Phillips Curve showed that there was a trade-off between the inflation rate and the unemployment rate. Alban Phillips based the original work on data from the UK from 1861-1957. The result was an inverse relationship between unemployment and the rate of inflation, meaning that an increase of one led to the decrease of the other. The trade-off suggested that policymakers can target low inflation rates or low unemployment, but not both

In the 1970s, the UK economy experienced stagflation (higher unemployment and higher inflation), and many economists believed that the Phillips Curve had broken down. Monetarist economists criticized the Phillips Curve because they argued there was no trade-off between unemployment and inflation in the long run.

The Phillips Curve Trade-Off

An increase in aggregate demand causes an increase in real GDP. Therefore firms employ more workers and unemployment falls. However, as the economy gets closer to full capacity, we see an increase in inflationary pressures. With lower unemployment, workers can demand higher money wages, which causes wage inflation. Firms can increase prices due to rising demand. Therefore, in this situation, we see falling unemployment, but higher inflation.

Thus, the government could choose a lower unemployment rate at a higher cost of inflation or lower inflation at the cost of higher unemployment. The Phillips Curve supported the Keynesian theory that an increase in Aggregate Demand led to lower unemployment but built inflationary pressures.

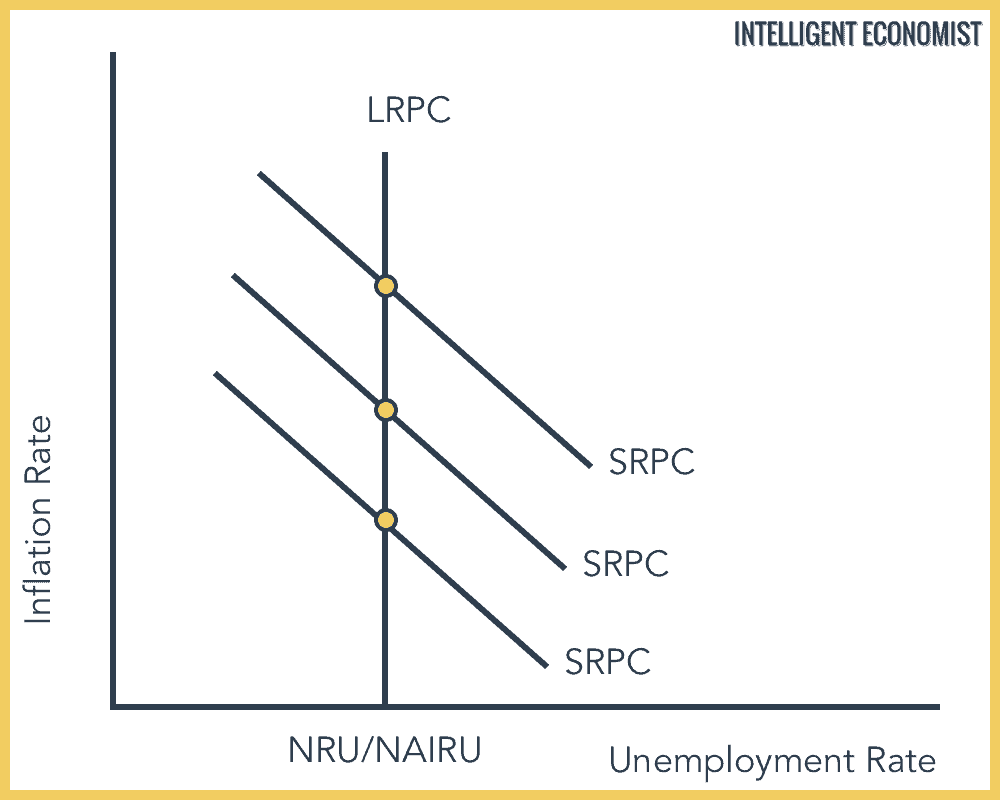

The Long Run Phillips Curve

The Long Run Phillips Curve was devised after in the 1970s, the unemployment rate and inflation rate were both rising (this came to be known as stagnation). Economists Ed Phelps and Milton Friedman claimed that the Phillips Curve trade-off only existed in the short run, and in the long run, the Phillips curve becomes vertical. You can see The Long Run Phillips Curve as the vertical line at the natural rate of unemployment, where the rate of inflation does not affect unemployment.

If the government tries to lower unemployment below the Natural Rate of Unemployment (NRU), then they will succeed in the short run at the cost of increasing inflation permanently.

The tradeoff between unemployment and inflation works in the short run because of ‘money illusion,’ where workers are slow to anticipate the inflation in the next year. Say the current inflation rate is 3% and the natural rate of unemployment is 5%, so in the short run when the government tries to reduce the unemployment rate to 4%, the inflation rate increases to 5%. Firms hire more workers during the expansionary policies, however, workers don’t realize that the inflation rate is 5% and not 3%, and when they demand higher wages firms have to fire extra workers, so unemployment returns back to 5%.

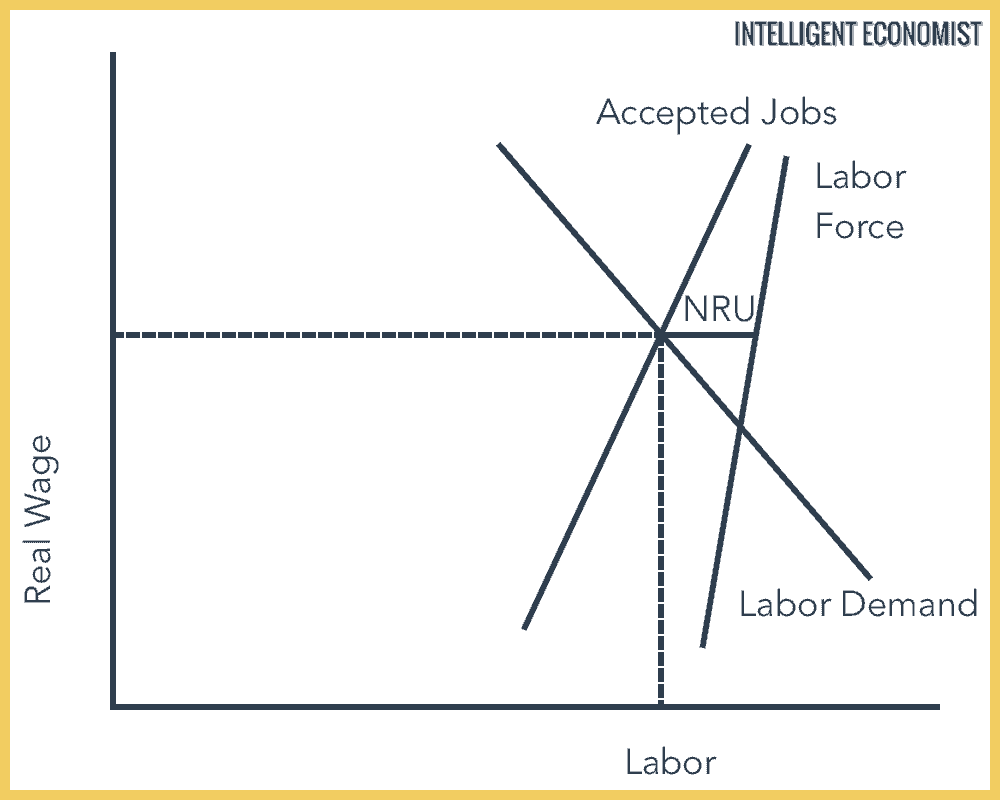

Non-Accelerating Inflation Rate of Unemployment (NAIRU)

Unexpected inflation might allow unemployment to fall below the natural rate by temporarily depressing real wages, but this effect would dissipate once expectations about inflation were corrected. Only with continuously accelerating inflation could rates of unemployment below the natural rate be maintained.

Any decrease in the unemployment rate is temporary. In the long run, expectations are adjusted, and there is no trade-off between unemployment and inflation. The Natural Rate of Unemployment is compatible with any rate of inflation, as long as the rate of inflation does not accelerate. The Non-Accelerating Inflation Rate of Unemployment or NAIRU is that level of unemployment that can be sustained with a change in the inflation rate.